World news

AMERICA, ASIA, ASSOCIATED PRESS, BRAZIL, DONALD TRUMP, ECONOMICS, EUROPEAN UNION, FOX NEWS, INDIA, INFLATION, KA, NATIONAL SECURITY, NORTH AMERICA, PETER NAVARRO, POLITICS, REPUBLIC, SOUTH AMERICA, SOUTH KOREA, THE ASSOCIATED PRESS, TREASON, TRUMP, UNITED STATES, US, WHITE HOUSE

Jamal Robinson

0 Comments

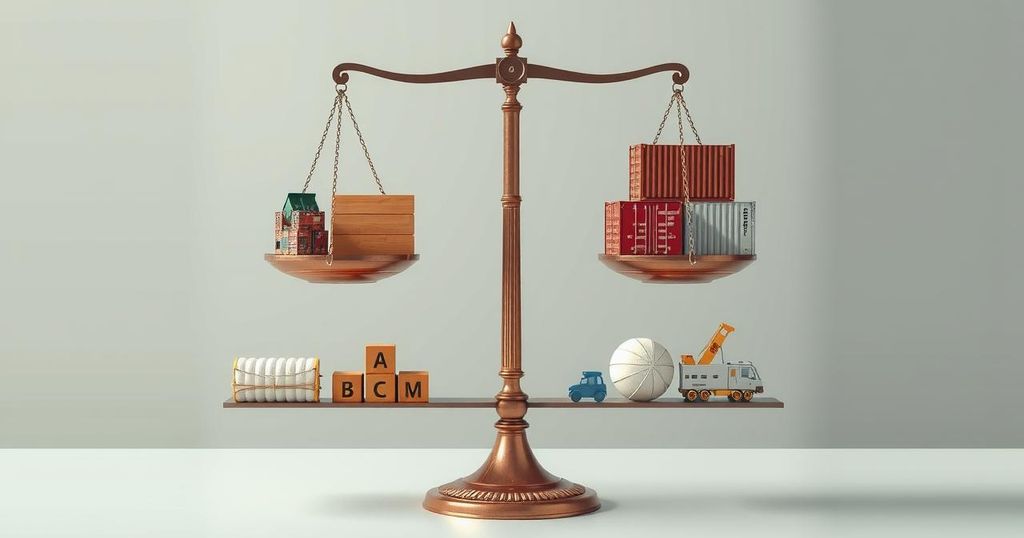

Donald Trump’s Reciprocal Tariffs: Implications for Global Trade and India

President Donald Trump plans to implement reciprocal tariffs on imports starting April 2, aimed at protecting U.S. industries and generating revenue. While details remain unclear, estimates suggest average tariff rates could reach 20 percent. The move could lead to increased consumer prices and retaliatory measures from trading partners, further complicating international trade relations.

Since Donald Trump resumed his presidency in January, his administration has adopted an assertive approach to tariffs. On April 2, 2023, he announced the implementation of reciprocal tariffs on imports from foreign countries, a move he referred to as ‘Liberation Day.’ The rationale behind these tariffs is to equalize duty rates with those imposed on U.S. products by other nations, thereby reducing U.S. reliance on foreign goods.

White House press secretary Karoline Leavitt indicated that Trump’s tariff plans for U.S. trading partners would be unveiled shortly. However, the specific details of these tariffs remain uncertain and are contingent upon the president’s disclosures. Economists caution that broad tariffs could ultimately have adverse effects, leading to higher consumer prices and financial strain on international businesses.

The impending tariffs may be classified as ‘by-product duties,’ influencing all goods from each country, reflecting the rates other nations impose and their domestic subsidies. Senior advisor Peter Navarro projected potential revenue generation of $600 billion, estimating an average tariff rate of 20 percent. Talks are ongoing between India and the U.S. regarding a bilateral trade agreement, yet no tariff exemptions have been confirmed to date.

Starting April 2, the United States will apply a 25 percent tariff on all imports from countries purchasing oil or gas from Venezuela. Additionally, a 25 percent tariff on automobile imports will come into effect the very next day, with regards to fully-imported vehicles and relevant auto parts. The administration anticipates accruing about $100 billion from these tariffs.

Previously established tariffs include a 10 percent levy on all Chinese imports, effective March 4, prompting retaliatory measures from Beijing. Trump’s expanded tariffs on steel and aluminium products, which also began in March, emphasize his intent to eliminate certain exemptions and raise the aluminium tax rate from his previous tariffs. Furthermore, a temporary delay on these tariffs for Mexico and Canada is set to expire on April 2.

As Trump continues to suggest potential tariffs on a broad array of imports, he has asserted that he will not engage in negotiations regarding these taxes prior to their implementation. This includes permanent tariffs on automobiles. The European Union, in response, has indicated it will impose tariffs on selected U.S. products nearing $28 billion, with measures phased over time.

The introduction of reciprocal tariffs by President Donald Trump marks a significant shift in U.S. trade policy aimed at protecting American industries. While these tariffs are expected to generate substantial revenue, their potential impact on consumer prices and global businesses raises concerns. Moreover, ongoing trade negotiations with countries like India highlight the complexities of navigating international trade relations amidst rising tariffs.

Original Source: www.hindustantimes.com

Post Comment