Cars

AFRICA, ARGENTINA, ASIA, AUSTRALIA, AUTOMOTIVE INDUSTRY, BOLIVIA, CHILE, CHINA, CONGO, CONGO - KINSHASA, CONGO (KINSHASA), CUBA, EXPORT, FOREIGN INVESTMENT, GEOLOGICAL SURVEY, INDIA, INDUSTRY, JAPAN, KINSHASA, MEXICO, MINING, NATIONAL GEOSPATIAL - INTELLIGENCE AGENCY, NORTH AMERICA, OCEANIA, SOLAR POWER, SOUTH AMERICA, TEARLINE, TRIANGLE, U. S. GEOLOGICAL SURVEY, UN COMTRADE, UNITED STATES

Marcus Chen

0 Comments

China’s Unchallenged Dominance in Global Battery Minerals Trade

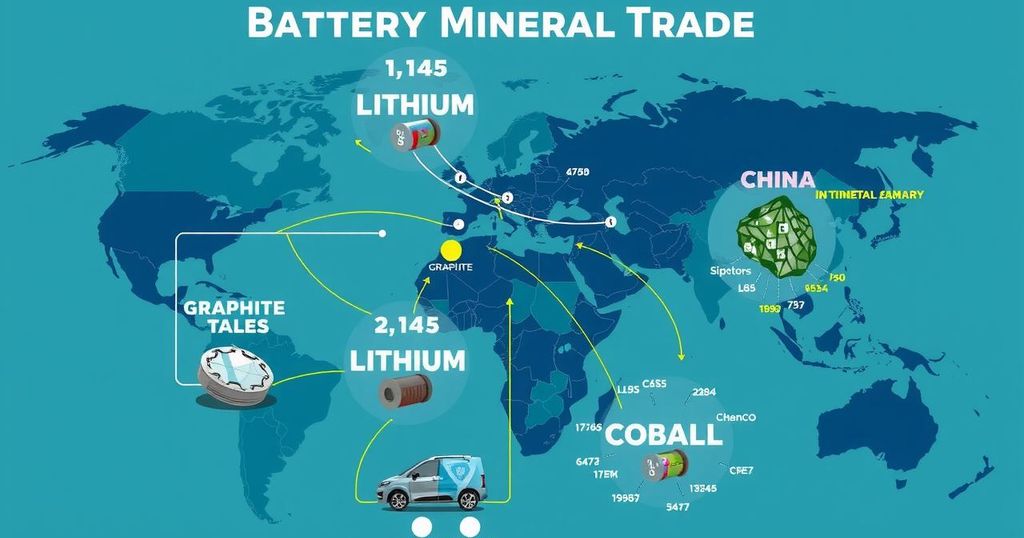

China is a dominant force in the global battery minerals market, controlling 44% of imports and 58% of exports in 2023. Key minerals include lithium, cobalt, and graphite, essential for battery production. With major investments in international mining projects, China’s influence is only expected to grow as demand for electric vehicles and energy storage rises.

China continues to solidify its commanding presence in the global battery minerals trade, playing a crucial role across every stage of the battery supply chain. In 2023 alone, China imported approximately 12 million short tons of battery minerals, representing a substantial 44% of interregional trade. On the export side, the country sent out nearly 11 million short tons of battery materials and components, making up 58% of interregional trade in the sector, as indicated by UN Comtrade data from regional sources.

Diving into specifics, the report highlights three pivotal minerals essential for battery production: graphite, lithium, and cobalt. These minerals are not only sourced from nature through mining or synthetic routes, but they are also vital for the manufacturing of battery materials. Given the rapidly rising demand for electric vehicles, energy storage solutions, and various energy technologies, the significance of these minerals can hardly be overstated.

Lithium, one of the key minerals, is primarily acquired via brine extraction or hard rock mining. Cobalt tends to be a byproduct of nickel and copper mining, and graphite can be extracted as a natural ore or synthesized from pitch and coke. Data from 2023 shows that China produced about 18% of the world’s mined lithium, amounting to roughly 33,000 short tons, while its firms controlled around 25% of the global lithium mining capacity.

Moreover, Chinese investments are heavily concentrated in the Lithium Triangle—an area spanning Argentina, Bolivia, and Chile—which contains about 50% of the world’s lithium. Back home, in 2024, China accounted for 79% (1.27 million short tons) of global natural graphite production, while U.S. production was nonexistent. Notably, Chinese enterprises dominate cobalt production in Congo-Kinshasa, controlling a staggering 80% of output from this region, which is responsible for over half the world’s cobalt.

After the raw materials are mined, they are shipped globally as feedstock for processing. In 2023, China was behind 46% of the world’s raw battery mineral imports. Australia, the leading lithium producer, directed nearly all its exports to China. Collectively, China, Australia, and various nations in Asia and Oceania, including India and Japan, constituted 71% of raw battery mineral imports in the same year.

China is not just a player in raw extraction; it has firmly established itself in processing as well, handling over 90% of the world’s graphite and dominating processing capacities for cobalt and lithium. Reports from 2023 indicate that China imported 20% of the world’s processed battery minerals, chiefly cobalt from Africa. Additionally, the country exported about 58% of processed battery minerals, focusing mainly on synthetic graphite to its Asian neighbors. Notably, export restrictions on graphite products were initiated in 2023, likely impacting future exports significantly.

In terms of battery materials, which differ based on a battery’s chemical composition, China facilitated 53% of global battery material exports in 2023. These materials are crucial in producing essential battery components such as electrodes, electrolytes, and separators. For instance, a standard lithium-ion battery cell incorporates a graphite anode, lithium-based cathode, and lithium salt electrolyte. According to recent figures, in 2022, China produced an impressive 85% of the global anodes, 82% of electrolytes, 74% of separators, and 70% of cathodes.

In a powerful showing, China controlled about 74% of the global battery pack and component exports in 2023, not to mention achieving nearly 85% control over the monetary value in battery cell production capacity. The continued growth in this domain is striking.

This data underscores China’s overarching influence and control in the battery minerals market, showing no signs of waning as demand for battery technology accelerates.

In summary, China plays a pivotal role in the global battery minerals market, dominating imports, exports, and processing of key minerals like lithium, cobalt, and graphite. With significant production capacities and investments in strategic mining regions, China’s influence is expanding as the demand for battery technology rises. The country’s policies, particularly regarding exports, could reshape future trade dynamics. Overall, China’s grip on the battery supply chain highlights the growing intersection of geopolitics and technology in a fast-evolving industry.

Original Source: batteriesnews.com

Post Comment