Cars

ASIA, AUTOMOTIVE INDUSTRY, BIDEN, BIDEN ADMINISTRATION, BRAZIL, CALIFORNIA, CHINA, CHRYSLER CORP, COLIN LANGAN, DONALD TRUMP, EUROPE, EUROPE/ASIA, FORD, GEOPOLITICS, HUNGARY, LANGAN, MEXICO, NATIONAL SECURITY, NISSAN MOTOR CO. LTD, NORTH AMERICA, RUSSIA, SOUTH AMERICA, SPAIN, STATES, TARIFFS, U. S, UNITED STATES, US-CHINA RELATIONS, WELLS FARGO SECURITIES

Jamal Robinson

0 Comments

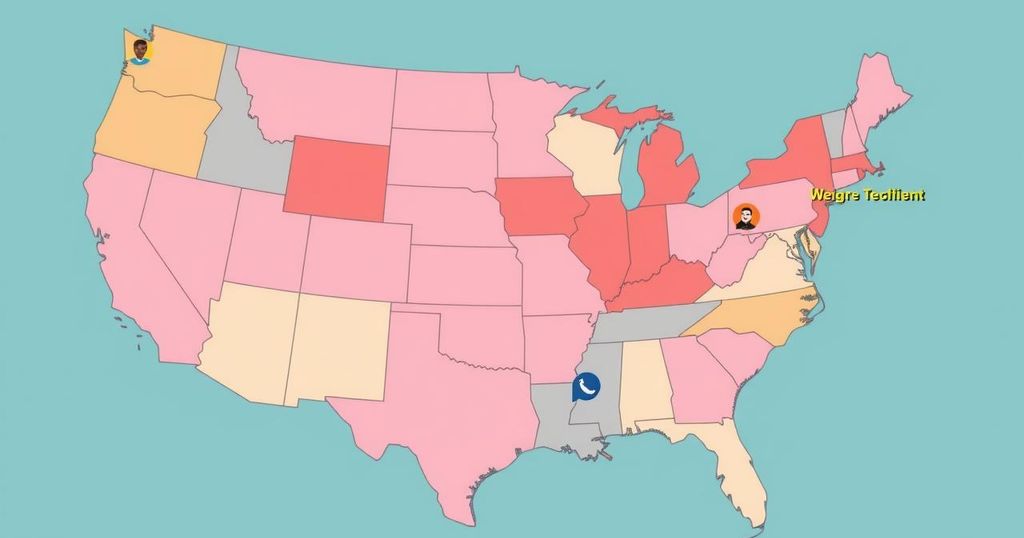

U.S. States Show Divided Stance on Welcoming Chinese Automakers

U.S. states demonstrate varying attitudes toward Chinese automakers, weighing billion-dollar investments against national security risks. Analysts foresee new entries into the U.S. market, with some states willing to foster partnerships while others exclude potential projects due to security concerns. The dynamics reflect past trends with Japanese and South Korean manufacturers reshaping the domestic industry.

U.S. states showcase a diverse array of responses to the possibility of welcoming a Chinese automaker. While the prospect of a billion-dollar investment promises extensive job creation, it simultaneously raises concerns about national security and public opinion backlash. Industry analysts believe a Chinese automaker, apart from those already operating, will likely begin manufacturing in the U.S. within the next few years due to increasing tariffs and regulations. Historical precedents show how Japanese and South Korean automakers successfully entered the U.S. market under similar circumstances, affecting the market position of domestic giants such as General Motors and Ford.

Colin Langan from Wells Fargo Securities expressed optimism regarding the future presence of a Chinese automaker in the U.S. assembly sector. He illuminated the dilemma faced by state governors, noting that refusal to welcome such investments risks high local unemployment. There is an indication of potential Chinese automakers establishing operations by either constructing new facilities or partnering with existing manufacturers that possess idle plants, as evidenced by Chery Automobile’s operations in Europe and BYD’s activities in Brazil.

The investment required for new manufacturing plants amounts to billions, while new regulations limit vehicles utilizing Chinese internet-connected technology from entering the U.S. market, posing further challenges for Chinese manufacturers, as noted by Sam Fiorani of AutoForecast Solutions. The Biden administration’s impending rule could compel a Chinese manufacturer to develop entirely new vehicles tailored for the American market, emphasizing the shifting landscape within which they must operate.

Despite some inclination to collaborate with Chinese firms, Michigan’s Economic Development Corporation remains reticent about specific projects. Governor Gretchen Whitmer has voiced concerns about the potential threats posed by Chinese automakers, aiming to protect Michigan’s automotive jobs and industry. Nonetheless, the state has already partnered with Gotion Inc., a Chinese battery manufacturer, reflecting a nuanced position towards investment from Chinese entities.

Contrarily, states like Texas have firmly stated their opposition to involvement with Chinese companies due to alleged national security threats. Texas Governor Greg Abbott’s spokesperson stated, “The Chinese Communist Party has made it clear that they can — and will — target and attack America’s critical infrastructure as part of their strategy to undermine the national security of the United States.”

States such as South Carolina and Georgia echo similar sentiments regarding national security and economic sovereignty, while New Mexico expressed a welcoming stance towards automotive projects from Chinese companies. New Mexico Governor Michelle Lujan Grisham’s office indicated they do not favor one nationality over another but emphasize responsible development aligned with national security considerations. On the other hand, Tennessee and Alabama also rejected engagement with Chinese projects, highlighting a trend among many states to remain cautious.

The possibility of utilizing closed or unused assembly plants presents another avenue for Chinese automakers, as Langan suggested, offering a potentially more favorable entry into the U.S. market. However, the number of available facilities has dwindled due to market changes and previous closures. As demand for new vehicles has yet to rebound fully post-pandemic, existing plants have struggled to operate at capacity, leading to uncertain prospects for prospective partnerships.

In summary, the receptivity of U.S. states to Chinese automakers is fraught with complexities, balancing economic incentives against national security concerns. Some states, including Michigan and New Mexico, display openness towards investment, whereas others, like Texas and Florida, maintain a staunch opposition. The evolving landscape suggests future developments may hinge on how stakeholders navigate these challenges, notably the regulatory environment and public perception.

Original Source: www.detroitnews.com

Post Comment